Last updated on June 6th, 2021

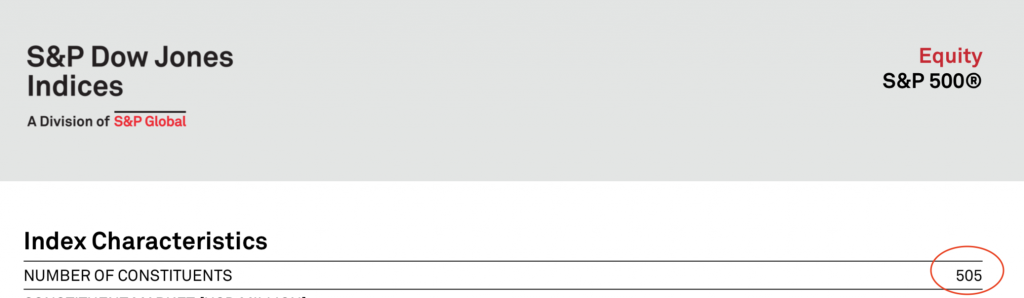

When you look at the holdings of the S&P 500, you may notice that it actually has 505 holdings!

Why are there 505 stocks in this index? Here’s what you need to know:

Contents

Why are there more than 500 stocks in the S&P 500?

The S&P 500 tracks the top 500 largest companies in the USA. However, some of these companies have multiple share classes. If the multiple share classes fit the criteria of the S&P 500, they will be included inside the index too.

Here’s an in-depth explanation about this phenomenon:

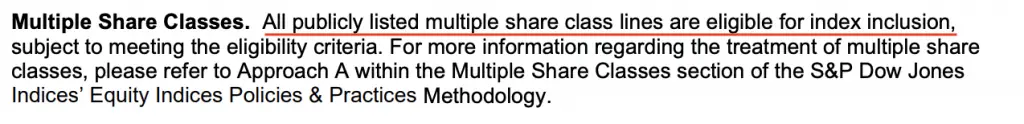

The S&P 500 announced an inclusion of multiple share classes into its indices in 2015

In 2015, the S&P Dow Jones Indices announced that it will include multiple share classes into their S&P 500 index.

Moreover, the weightage of these companies will be split among the 2 classes.

Based on the current S&P 500 holdings, there are 5 companies with multiple share classes being included in the S&P 500.

| Company | Share Class 1 | Share Class 2 |

|---|---|---|

| GOOG | GOOGL | |

| Fox Corporation | FOXA | FOX |

| Discovery Inc | DISCK | DISCA |

| News Corporation | NWSA | NWS |

| Under Armour | UAA | UA |

As such, there are 505 holdings within the S&P 500.

When a stock is publicly listed, the company may choose to adopt a multiple share class structure.

In this system, different share classes may have different amount of voting rights. For example, if you buy the GOOG (Class C) stock, you do not have any voting rights.

Meanwhile, the GOOGL (Class A) stock will give you voting rights!

These companies usually have different share classes to preserve the control of the company with a certain group of people. This group of people are usually the founders of the company.

The class structure depends from company to company

There is no fixed way that a company can structure their shares.

For example, Google’s Class B shares are not publicly traded and are held by their founders.

Meanwhile, Nike’s Class A shares are also not publicly traded and gives the shareholder the power to elect 9 out of Nike’s 12 board members!

It can be very confusing to understand why some companies have Class A shares, while others have Class B shares that are listed on the S&P 500.

The S&P 500 wants to put a stop to this multiple share class structure

The S&P 500 has stopped accepting companies with multiple share classes into their index.

This move was mainly targeted towards Snapchat, which sells shares to investors without giving them voting rights.

However, companies that have multiple share classes before this announcement (in 2017) would still be able to remain.

The 5 companies that have multiple share classes all existed before 2017, so their stocks will still be in the S&P 500!

The S&P 500 is one of the most well known indices in the world. If your company is included in the index, it is considered to be very prestigious!

It was hoped that companies will be discouraged from using this loophole to ensure that their founders get to stay in control!

Because of this, a few companies have not been included in the S&P 500 due to their multiple share class structure, as:

For a company that has multiple share classes, they are eligible to be included into the index as well.

However, they would need to meet certain eligibility criteria too! Here are the 2 main conditions that the second share class needs to fulfil:

| Factor | Definition |

|---|---|

| Liquidity | Ratio of annual dollar value traded to float-adjusted market capitalisation should be at least 1.00 Stock should trade a minimum of 250,000 shares in each of the six months leading up to the evaluation date |

| Investable Weight Factor (IWF) | An IWF of at least 0.10 is required (i.e. a public float of at least 10% shares outstanding) |

However to be listed on the S&P 500, the company must meet these criteria as well:

| Factor | Definition |

|---|---|

| Market Cap | At least $9.8 billion |

| IPO Eligibility | IPOs should be traded on an eligible exchange for at least 12 months before being considered for addition to an index |

| Financial Viability | The sum of the most recent four consecutive quarters’ Generally Accepted Accounting Principles (GAAP) earnings should be positive |

Factors like the market capitalisation are only measured at the company level. As such, the different share classes do not need to fulfil these criteria by themselves!

This is why you may see some companies like Mastercard, Visa or Nike having ‘Class’ at the end of their names. However, you can’t find another class of the company’s shares on the S&P 500!

The share classes are not found on the S&P 500 because they do not meet the index’s inclusion criteria.

Here are some examples of why certain share classes are not included in the S&P 500:

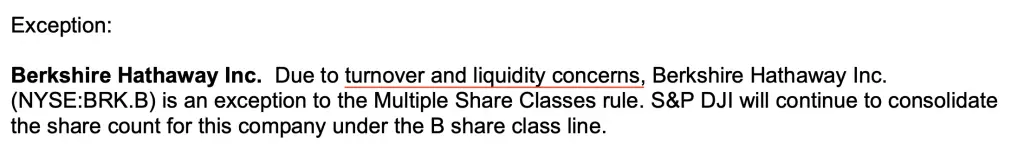

#1 Berkshire Hathaway A (BRKA) is too illiquid

The BRKA stock is listed on the NYSE. However, it has an extremely low liquidity.

The average trading volume of this stock is 365!

One reason why this is so is due to the stock’s high price of around $360,000!

Since it trades less than 250,000 shares a month, BRKA is considered to have low liquidity. As such, it cannot be included inside the S&P 500.

Instead, only the Class B share (BRK-B) is included in the index!

This was also mentioned in the S&P DJI’s index methodology:

#2 Facebook Class B shares are not tradable on the US markets

Facebook has 2 share classes: Class A and B.

However, you are only able to find Class A shares to be traded on the stock exchange.

This is because the Class B shares are executive shares. These shares give the owner 10 votes each, and they are not publicly traded.

As such, Mark Zuckerberg is still able to have a controlling stake of around 58%!

Since the Class B shares are not listed on the US markets, they cannot be included in the S&P 500 index.

This is similar to Visa Class B shares and Nike Class A shares which are not traded publicly.

Conclusion

The S&P 500 includes the US’ top 500 companies based on their market capitalisation and other factors. However, some of these companies have multiple share classes.

This is why there are 505 stocks in the S&P 500, even though there are only 500 companies!

Moreover, some companies may have multiple share classes, but only one share class is listed on the S&P 500.

This is because these share classes are either too illiquid, or are not publicly traded!

If you are looking on how to invest in the S&P 500 from Singapore, you can check out my guide to find out more.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?